2022-H1 2023: Adapt & Evolve

Heading

Foreword from Authors:

I. Executive Summary

I

Outsourcing and R&D experienced the predicted decline.

The market saw consolidation of certain asset groups. We saw a dozen public deals and up to four dozen non-public deals, a significant number of which were distressed assets. Only 4% of outsourcing companies completely laid off their outsourcing team or closed their R&D office, rather than just stopping or reducing hiring. This happened in two waves in spring and December 2022. Overall, outsourcing faced more of a lack of orders than losses.

ІІ

The product lost everything on the local market in March and recovered by August.

Local product IT companies experienced a 70%+ drop in the first months of 2022. Still, thanks to tectonic changes in the economy, including massive relocation and new export and import chains, many met their yearly business targets. Some large local retailers, telecommunication, and logistics companies have reorganized their tech departments as separate product IT companies. DefenceTech's domestic market, which employs up to 10 thousand people, has taken shape.

IІІ

Global market products were hardly affected.

Product companies focused on the foreign market turned out to be the most resilient from an economic angle. Still, they took the opportunity to cut inefficient divisions and spinoffs. The market saw several acquisitions and investments in such companies at absolute market valuations.

ІV

Startups suffered the most.

No miracle happened in terms of foreign funds' attention to Ukrainian startups, and out of 18 local funds, only 6 continued to invest. While 7 new ones were added. 79% of early-stage startups survived, with 84% of them physically moving out of Ukraine in whole or in part. At the same time, two and a half hundred new startups were added to catalogs and competitions from within the country, not counting Defence tech. In total, the market saw 98 investments in local startups in 2022, which is less than in the fruitful 2021 but more than in 2020. The first half of 2023 saw 14% fewer investments than in 2022.

V

Developer salaries remained unchanged, new non-technical hires became cheaper, and the number of vacancies fell twofold.

Out of 348k people in the Ukrainian IT industry, 67k left the country, and several tens of thousands entered the industry from other countries. Between 25k and 34k lost their jobs at the initiative of companies. About 40% were looking for a new job in 2022-H1 2023, with half of them taking 2 months to find it, and a quarter finding it with better pay. The offer for Ukrainian specialists for a year and a half amounted to 320 000 - 350 000 vacancies. It became harder to find a job, but the average salary for developers did not change. The scenario of a salary decrease across the market in the summer of 2023 did not materialize.

VI

More government regulation of IT.

The industry is still wary of the Diia.City's special tax regime for IT. The regime has 600 residents, but most companies have only “one foot in the door.” It has been 2 years since the legalization of gambling and betting, which were supposed to fill the budget but instead got into a series of scandals due to miscoding, so now it seems that we are working on the mistakes. The “Google tax” brought in about $90 million to the budget. The Diia app, with its digital government services, which had been criticized for lags and insufficient security before the war, faced the challenges of war and foreign equivalents, and Ukrainians began to sing praises to the app.

II. Ukrainian Tech in a Nutshell by 2023

IT specialists as of January 1, in thousands (k):

2023 — 348k, of which 66.92k left the country during this period and did not return as of H1 2023, of which 28.7k have no plans to return

2022 — 307k

2021 — 256k

2020 — 231k

2019 — 194k

2018 — 167k

2017 — 149k

2016 — 135k

Total number of IT companies / with vacancies as of January 1 / added to the catalogs of Ukrainian IT companies, in thousands (k):

2023 — 8.9k / 1.35k–2k / +440

2022 — 9.6k / 6k / +1,050

2021 — 8.7k / 5k

2020 — 8.4k

2019 — 8.1k

2018 — 7k

2017 — 6.3k

Investments and grants in IT:

2023 — 74

2022 — 179

2021 — 320

2020 — 171

2019 — 83

2018 — 76

2017 — 80

2016 — 122

2015 — 90

2014 — 124

2013 — 96

2012 — 54

2011 — 23

2010 — 19

2009 — 8

Investments and grants in IT, mln $:

2023 — $111

2022 — $631,5 (62 % — Matter Labs, Preply, AirSlate, DataArt)

2021 — $956,8 (50 % — Grammarly, Firefly Aerospace, People.ai)

2020 — $415,7 (78 % — Restream, Creatio, GitLab, AirSlate)

2019 — $542,8 (77 % — Grammarly, Gitlab, People.ai)

2018 — $287,4 (79 % — GitLab, BitFury, People.ai)

2017 — $235 (76 % — Grammarly, AirSlate, BitFury)

2016 — $115,3 (51 % — Rozetka, Busfor)

2015 — $51,4

2014 — $82,1

2013 — $90,6

2012 — $56,9

2011 — $18,0

2010 — $58,4

2009 — $6,6

M&A in IT:

2023 — 4

2022 — 25

2021 — 43

2020 — 16

2019 — 20

2018 — 12

2017 — 16

2016 — 14

2015 — 15

2014 — 16

2013 — 13

2012 — 12

2011 — 25

2010 — 15

2009 — 3

M&A in ІТ, mln $:

2023 — $130

2022 — $111,1

2021 — $225,8

2020 — $135,6

2019 — $910,8 (80 % — Vodafone Ukraine)

2018 — $12

2017 — $505,1 (98 % — Plarium)

2016 — $20,1

2015 — $279,2

2014 — $54,7

2013 — $80,2

2012 — $49,6

2011 — $1374,2 (94 % — Ukrtelecom)

2010 — $420,6 (95 % — Kyivstar)

2009 — $1,0

IT export revenue, b $:

2023 — $2.8b

Jan — $528m

Feb — $547m

Mar — $600m

Apr — $539m

May — $590m

Jun — $573m

2022 — $7,3b

Jan — $528m

Jul — $542m

Feb — $547m

Aug — $621m

Mar — $600m

Sep — $578m

Apr — $539m

Oct — $535m

May — $590m

Nov — $580m

Jun — $573m

Dec — $751m

2021 — $6,9b

Jan — $418m

Jul — $574m

Feb — $480m

Aug — $594m

Mar — $546m

Sep — $621m

Apr — $556m

Oct — $638m

May — $502m

Nov — $675m

Jun — $547m

Dec — $792m

2020 — $5b

2017 — $2,5b

2019 — $4,2b

2016 — $2b

2018 — $3,2b

2015 — $1,7b

Share of IT in Ukraine's GDP/exports:

2022 — ~4,6 % / 45,5 %

2018 — 2,4 % / 20,2 %

2021 — 3,5 % / 37,8 %

2017 — 2,2 % / 17,4 %

2020 — 3,2 % / 32,3 %

2016 — 2,1 % / 15,9 %

2019 — 2,7 % / 23,7 %

2015 — 1,8 % / 13,4 %

Unicorns:

The 11 confirmed lifetime unicorns met two criteria at once: they had or still have at least one Ukrainian co-founder and a development office in Ukraine. The list includes: AirSlate, BitFury, BigID, Firefly Aerospace, GitLab, Grammarly, People.ai, Playtika, Revolut, Unstoppable Domains, and WhatsApp.

III. People and Companies

Overview

The industry comprises 348k people and 8k legal entities.

Out of 8k legal entities, 1.3-2.1k are operating IT companies. Other legal entities are either inactive or are additional legal entities of established companies. At the same time, from January 2022 to H1 2023, a total of almost 1.5k IT companies were added to various local IT catalogs — employers/startup maps, etc.

Out of 348k people, almost a third, 104k, work for the 75 largest companies in the market. The growth in the number of talents is primarily due to those registered as individual entrepreneurs, who account for about ⅔ of the entire labor market today. 18.9% are currently outside the country.

Distribution of people in the industry

Distribution of people by company type:

Outsourcing and outstaffing — 56%

R&D (Ukrainian development offices of foreign product companies) — 9%

Tech departments of local non-IT companies (banks, telecom, logistics, energy, pharma, retail, agri) — 5%

Freelance — 2,1%

Sales offices of international tier1 companies, digital, IT agencies, call centers — 1,9%

Product, incl. startups — 26%

Popular industries among respondents

In fact, ⅔ of people work in outsourcing, and ¼ work in product. At the same time, there are 2 times more product companies than outsourcing. Over 40% of outsourcing companies employ more than 100 people, while only 10% of product companies employ more than 100 people.

Distribution of people by occupation:

Development, DevOps — 44%

QA — 12%

Development Management (Product, Project, Producer) — 11%

Marketing (General Marketing, SEO, Affiliate, PPC, ASO) — 8%

Analytics (2% – business analysts in outsourcing and 4% – product analysts) — 6%

Design — 6%

Бек-офіс (legal, HR & R, фінанси) — 5,9%

Content Creators (text, 2D/3D-artists, audio and video) — 3,5%

Sales і BizDev — 0,9%

C-level — 0,7%

Other — 2,9%

Popularity of programming languages among tech specialists:

JavaScript — 22,05%

TypeScript — 14,1%

Java — 13,65%

C# — 12,9%

PHP — 10,2%

Python — 7,35%

Kotlin — 3,05%

Swift — 3,55%

Go — 1,9%

SQL — 0,75%

Scala — 0,5%

C++ — 3%

Other — 4,85%

Ruby — 2,15%

English language proficiency:

Advanced and above — 18,3%

Upper intermediate — 40,63%

Intermediate — 29,64%

Pre-intermediate — 9,44%

Elementary — 1,95%

The salary of specialists of middle and higher level with English at the Upper-intermediate level or above is 25%-40% higher than that of specialists with lesser English skills

Fact

About 5.17 thousand people in IT, which is about 1.5% of the total, hold a Candidate of Sciences degree or higher.

Relocation, labor market conditions, involvement in the AFU

The Ukrainian tech talent pool and the IT ecosystem proved resilient in the face of war. For their part, Local and foreign companies actively contributed to supporting their own offices and regional and national initiatives.

About 87% of talents kept their jobs at the initiative of companies and continued to show high delivery rates despite massive relocation and blackouts.

Relocation

Distribution of relocated specialists:

21% of specialists in 2022 and 2% in 2023 relocated abroad

46% relocated inside Ukraine

31% did not relocate.

Of those who went abroad in 2022-2023:

82% to 86% did so after the start of the full-scale invasion, and 14% to 18% did so in the weeks before;

41 % and 59 % is the distribution of women and men, respectively;

> 50 % are senior-level and above;

69 % received assistance with relocation from the company;

30% have lived in 2 countries, 17% in 3, 4% in 4, 2% in 5 or more;

65,5 % have not changed their employer;

7 % have returned;

40 % — currently do not plan to return even after the end of the war.

Of those who did not relocate or relocated within Ukraine in 2022-2023:

59 % relocated within Ukraine, of whom 52 % have already returned;

39 % would relocate to other countries;

14 % are contemplating leaving the country but have not decided yet.

Where have Ukrainian companies relocated?

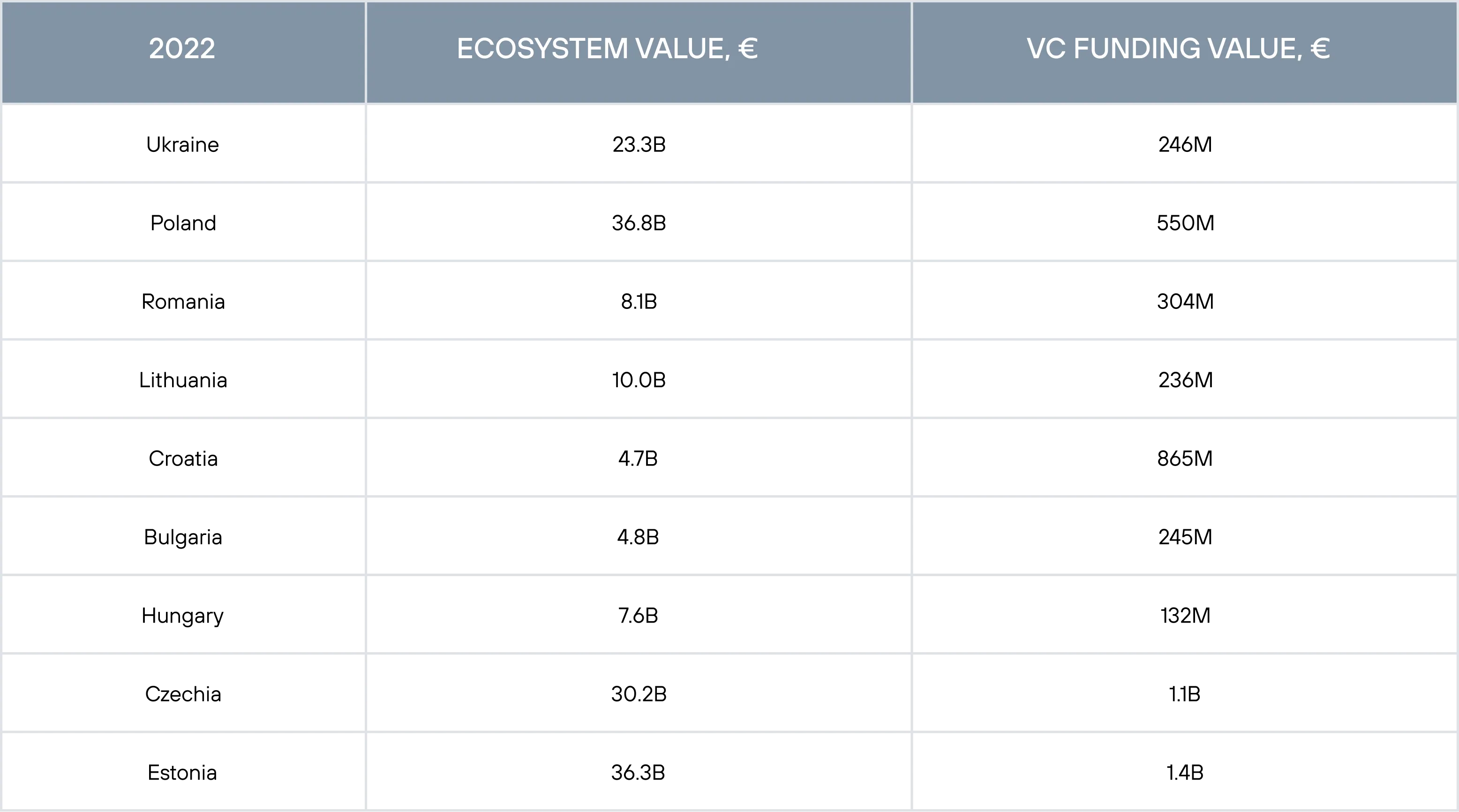

In 2022-2023, 46 of the top 50 companies opened new development offices outside of Ukraine, employing about 20k people in total. The most popular locations for new hubs have become neighboring Poland, Bulgaria, and Romania, as well as Cyprus, Turkey, and the LatAm countries. The largest number of launches of new R&D offices by Ukrainian companies took place in April, August, and October 2022.

8,75 % of all companies did not just open a new office abroad but closed the Ukrainian one, i.e., completely relocated. Of these: 61 % — are angel, pre-seed, seed, and A-round startups, 29 % are projects of foreign companies within outsourcing and outstaffing companies, and 2 % are standalone R&Ds of foreign companies, the most notable of which is Swedish NetEnt, which employed about 100 people in its Kyiv office.

work

-

40 % of specialists were looking for a new job in 2022, of which almost a third were looking for a new job as a result of dismissal or project closure and transition to bench.

-

2,1 % left IT.

-

6,5 % of people are informed about the end of their work in outsourcing / outstaffing / R&D during the year.

-

11 % are unemployed as of Q1 2023, including:

-

half of them are juniors, 80% of whom are switchers from other occupations.

-

the other half are seniors and leaders who have become either too expensive for outsourcing or have not produced commercial results in terms of product.

-

only 30% of them speak English at the upper intermediate level or above.

-

-

14 % of companies planned to downsize their Ukrainian offices in 2023.

In absolute terms, we know about more than 25k people who were laid off at the initiative of companies.

Labor market supply and demand dynamics change curve:

Monthly growth: 3.8k new paid vacancies on DOU and 14k new free vacancies on Djinni.

In total, from March 2022 to July 2023, about 80k paid and 319k free vacancies in IT companies were published on the above and other resources.

Major drop dates - the beginning of the invasion in February 2012 and blackouts in December 2012 .

The number of applications per vacancy on average in the industry increased 5 times from January 2022 to H1 2023.

Employment challenges in IT, without division into occupations:

The percentage of those who received their salaries in full and without delays ranged from 63,2 % to 79,6 %

One in 5 faced problems with their salary

In 8,1 %-9 % of cases, salaries were reduced

7 % were paid in full, but with considerable delays

4,4 % of respondents received a salary bump purely as support from their employer.

Salaries

Developer median salary:

Despite the fact that over the year and a half of the invasion, 25k to 33.8k people were fired at the initiative of companies or transferred to bench, the median salary of developers was not affected (yet).

Developer median salary, another estimate:

Less than 1% of developers are paid $10,000+.

The median salary of a developer per month based on the aggregated data of DOU and AIN.UA is $2,930.

Median salaries in IT occupations in the Business category:

The median salary for business occupations in Ukrainian IT, namely Product, Project, analysts, all types of marketers, and salespeople, according to AIN.UA, is $1,780.

Salaries in Ukrainian IT in general, compared to other countries:

For comparison, the average annual base salary for IT, including everyone from junior sales reps to system architects, in Ukraine is about $20 thousand per year.

Among the locations popular in 2022-2023, where new R&D offices were opened globally, only Hungary, Bulgaria, and Croatia are cheaper than Ukraine in this regard, with a much smaller talent market. And taking into account the 5% tax, Ukraine outperforms them here as well.

AFU, Reservations, Donations

-

Out of 340k IT specialists, about 180k are liable for military service.

-

IT constitutes 2.1% of all reservations.

-

2,5 % are reserved among all IT, and soon there will be fewer of them. After all, 2.13% of them were reserved under the old 2022 procedures, which have already expired or will soon expire, and 0.37% under the updated 2023 procedures, which most businesses have not tried out and are not planning to.

-

1.97% serve in the Armed Forces of Ukraine, of these, ⅔ volunteered and ⅓ were drafted.

-

The average age of IT specialists in the Armed Forces is 35.

-

In 70% of IT companies, the share of employees in the Armed Forces is less than 2.4%. In 10% of companies, it is over 20%.

-

⅔ of the respondents interviewed by the editorial board donate up to 10% of their salary to the Armed Forces and civilian initiatives, ⅕ - up to 25% of their salary.

-

In absolute terms, according to AIN.UA, 13% of donations amount to more than $1,000 per month.

BUSINESS OVERVIEW

The financial performance of businesses in 2022-H1/2023 depended to a large extent on the type of company and the market in which it operates.

I

Dependence on the Russian market

Historically, Ukrainian IT has not had a significant dependence on the Russian market of users or customers, unlike the old knowledge-intensive industries. About ¾ of outsourcing, which employs 64% of Ukraine's talents, and almost all local product companies have focused their business models on the global market since their inception. Russia may have been a part of it, but it was definitely not the main source of revenue. Since Russia's occupation of Crimea in 2014, these ties have further diminished. The only exceptions where ties to the Russian IT ecosystem were strong in Ukraine were affiliates, game devs, and advertising and PR agencies. But in the short term after February 24, 2022, with rare exceptions, they also ceased to exist. For example, the largest Ukrainian marketplace Prom.ua closed its Tiu.ru. Several outsourcers based in Russia and Belarus with offices in Ukraine have also left. The biggest ones are EPAM, Luxoft, and DataArt.

ІІ

Domestic market

In the first few months, many product companies in Ukraine experienced a significant decrease in revenue. Ukrainians stopped buying online and canceled subscriptions to digital services. However, in late spring, these revenues began to return. People who lost everything in the occupied territories or under Russian attacks were "getting it back" at Rozetka, the largest online retailer, which suffered a 77% drop in sales at the beginning of the year and had to sack almost its entire IT department. People who lost their jobs searched for them on the largest job search site, Work.ua, which eventually outpaced its 2021 performance. People used the largest Ukrainian taxi service, Uklon. Most entertainment services, such as the OTT service Megogo, did not recover to pre-invasion levels. Games, streaming, and other entertainment services experienced unprecedented growth when people were cooped up at home with the onset of COVID. However, their performance declined after the epidemic ended.

IІІ

Global market

Speaking of outsourcing, during the 500 days of the war, approximately 31% of large and medium-sized companies experienced a 10% to 50% drop in revenue. The issue was the lack of new orders and the partial loss of existing ones. Despite the full restoration of infrastructure and business processes by the beginning of May, most outsourcing companies voiced the following reasons for customer refusals: war-related risks, inability to organize temporary departures of men of military age, and lack of a transparent and coordinated reservation mechanism, primarily FOPs, of which more than ⅔ in Ukrainian IT. At the same time, more than half of the outsourcing companies reported revenue growth despite the above losses. Export revenues from IT in 2022 amounted to $7.3 billion, compared to $6.9 billion in 2021. But in the first six months of 2023, it amounted to only $2.8 billion. Although the second half of the year traditionally shows better financial performance than the first, the decline is likely to continue. On the other hand, there is a new wave of interest. In late fall 2022, it became evident that Ukrainian developers were capable of delivering builds on time, even amidst blackouts. This renewed interest in Ukraine as a location with some of the most favorable taxes worldwide and an Israeli model for predicting the development of events. The market has seen several notable investments, M&A, and isolated increases in the number of vacancies. As for product companies operating on the foreign market, they were the least vulnerable and most reported fulfilling business plans in 2022, which were drawn up before the full-scale Russian invasion. Some B2C businesses have “suffered” much more from apple transparency and other similar regulations. However, at least a third of the surveyed grocery companies also took the opportunity to cut back on C-levels and commercially inefficient internal startups around their core business models.

IV. VC, M&A, and Grants

Market Overview

In the period from 2000 to 2023, Ukrainian IT companies participated in 1,868 publicly disclosed deals, 87% of which were made in the last 10 years.

1,868 are assets with EITHER a dedicated Ukrainian development office with 50+ employees OR a smaller staff with a Ukrainian co-founder. In other words, these are cases in which money physically enters the local ecosystem.

Number of deals, 2009-2023

Over the past 15 years, since 2009, 1,798 deals have been recorded. Of these, 1,519 involved raising money for a total of some $3.7 billion, and 248 involved mergers and acquisitions worth $4.3 billion.

Number of deals by simplified types*, 2009-2023

*Investments — Early Stage VC, Later Stage VC, Angel, Grant, Crowdfunding, Private Equity;

M&A — M&A

Other — IPO і Debt Financing.

Investments

Number of investments by type, 2009-2023

Valuation of investments by type, in millions US dollars, 2009-2023

Number of Early Stage investments*, 2009-2023

*this graph includes only early stage investments with a known subtype - accelerator/incubator, pre-seed, or seed.

Valuation of Early Stage investments, in millions US dollars, 2009-2023

Number of Later Stage* investments, 2009-2023

*this graph includes only later stage investments with a known subtype - from A to E.

M&A

Well-known mega-M&As with 1+ billion checks in companies with noticeable (not core) development offices in Ukraine and without a Ukrainian co-founder are counted separately. Despite having thousands of developers in Ukraine, they are statistical outliers and do not demonstrate the venture capital landscape of the Ukrainian market in particular:

18 Months of War

Nykyta Izmaylov

CEO & Founder N1 investment fund:

The investment market in Ukraine has suffered a significant decline, which is not surprising given both the full-scale war and the economic crisis in the world. Investments decreased not only in Ukraine but also in other parts of the world last year. Tech giants underwent massive layoffs, withdrawals from accounts instead of IPOs, and finally, the collapse of Silicon Valley Bank in March 2023.

Ukraine is losing a lot of people every day in the war, including those who were driving its economy forward. Unfortunately, this is our reality. Therefore, as a country, we need the military tech industry. After the victory, Ukraine has every chance to become a world leader in military technology. We already have our own defense tech cluster, BRAVE1, supported by the Ministry of Digital Transformation, and many new startups producing drones, mine detectors, etc. Among them are UA Dinamics (Punisher drone developer) and GRIZELDA, a developer of AI software solutions. The market for countering disinformation is also developing rapidly. This spring, it became known that one of the Ukrainian funds, SMRK, had invested $1 million in the Ukrainian project OSAVUL. Based on LLMs (Large Language Models), OSAVUL analyzes social media texts for propaganda. In the coming years, such investments will be more relevant than ever. After all, Ukrainians have learned to exist in the new reality, and the Ukrainian VC and PE market is adapting to the new conditions as well. One of its peculiarities now is that local funds and startups operate from different countries, most of them outside Ukraine, which makes them less risky. In other words, a Ukrainian startup is now a startup with Ukrainian founders and a team that can be scattered around the world. Naturally, most startups need financial support, which is what we are trying to do with the N1 team. Also, adaptation does not mean that indicators and multipliers have returned to pre-invasion levels. It means that the indicators have a positive trend, albeit a restrained one. Having said that, there will definitely be a boom in investment in Ukraine and Ukrainian startups after the victory, and to capitalize on this, you need to invest now.

scroll to see more

N1

OVERVIEW OF 2022-H1 2023

79% of startups with a Ukrainian co-founder and an office in Ukraine have not stopped operating after 500 days of war.

As of H1 2023, 84% of startups have at least one co-founder and part of the team abroad.

After February 24, the Ukrainian IT market saw a decrease in the number of investments not only from foreign venture capital funds. Of the 18 active local investment funds that had been operating in Ukraine for more than one year as of February 24, 2022, only 6 continued to operate since the beginning of the invasion. At the same time, 7 new ones were added: 3 were launched before the invasion, and 4 more in the first months after.

-

Funds that have been operating in Ukraine for more than a year and have continued to invest despite the war include SMRK, Horizon Capital, U.Ventures, TA Ventures, Flyer One Ventures, and N1 Investment Fund.

-

Funds that were launched a few months before the invasion include Geek Ventures, SID Venture Partners, and NetSolid Investments.

-

Funds that were launched after the invasion include Angel One Fund, Hypra, hi5 Ventures, and Vesna Capital.

-

3 of the 7 oldest Ukrainian funds, AVentures, CIG, and Digital Future, have no record of any new investments in Ukraine during the war.

-

Imperious Group, TMT, and Almaz Capital, which were active in Ukraine before 2014, had capital with signs of Russian origin and dramatically reduced or stopped new investment activity after 2014. However, these funds have mostly retained their existing Ukrainian portfolio to this day.

-

10 out of 25 funds are founded by local founders of B2C product companies with $10 million or more in annual revenues.

-

Half of the funds have between 10 and 19 lifetime investments, while the other half has between 3 and 8. Almost no one has 5 or more exits.

-

Most local funds do not have a partner who is permanently based in the country.

Fact

In September 2022, the American fund ff Venture Capital (ffVC) launched a $30 million Blue & Yellow Heritage Fund specifically for Ukraine, but no deals have been reported for the year.

Fact

The fund with the largest number of investments in Ukrainian lifetime startups is Digital Future with 31 investments.

Horizon Capital is the only fund that actually invests in Ukrainian companies at the later stages, with 16 investments.

The fund with the largest number of investments after February 24, 2022 is SID Venture Partners with 13 investments. Vesna Capital took the second place with 5 investments, and the third place was shared by 5 funds with 4 investments each.

INVESTMENTS

In 2022, the Ukrainian market saw an unexpected 98 investments (angels, early stage, later stage, and private equity), which is 27% less than 134 in pre-war 2021, but up from 93 in 2020. Of course, the multipliers have deteriorated, and many investors have disappeared. On the other hand, new investors have emerged, and in the face of uncertainty, those startups that had not planned to do so before or did not grow up in the venture capital field at all have rushed to secure a round.

In terms of money, 98 investments in 2022 amounted to $613 million, compared to $943 million for 134 in 2021, and $409 million for 93 investments in 2020. 2023 brought 42 investments worth $92 million in the first half of the year, which is a mere 14% less than in 2022. In terms of the dramatic difference in money between 2022 and 2023, which is not yet over, most of the deals in the first half of 2022 were often agreed upon and sometimes formalized before the invasion.

M&A

In addition, in 2023, the market saw Scopely and NeoGames deals worth $4.9 billion and $1.8 billion, respectively. Both have R&D in Ukraine with up to 30 and 170 employees, respectively.

They are listed in the mega-M&A table in Section 4.3 because they are statistical outliers and are more about these companies themselves than about the landscape of Ukrainian M&A.

ANGELS

In addition to funds, there are about 380 local angels investing in IT startups in Ukraine. In 2022, investments from such investors dropped by 2 times compared to 2021. And it is a complex issue. On the one hand, angels accounted for about 5% of the number of people with a net worth of $1+ million before the invasion, and in 2023 their number in Ukraine decreased by 54% compared to 2021. This is likely to be a case of both relocation and a reduction in wealth.

On the other hand, according to an estimate of fifty early-stage startups, the supply of angel capital has not disappeared and has even increased, as investments in the real sector have become more risky. Lastly, early-stage Ukrainian startups themselves in 2022-2023 were either afraid to take on Ukrainian angels or physically relocated to other jurisdictions.

Fact

81 % of angels had no previous experience with IT.

The top publicly known angels are Evgeniya Dubinskaya, Igor Liski, Roman Prokofyev, Petro Chernyshov, and Eugene Shneyderis.

GRANTS

In addition to investments from funds and angels, there were 80 non-equity grants in 2022 and 27 in H1 2023. There were 129 in 2021 and 94 in 2020. The context behind these numbers is that since the beginning of the invasion, the state-owned Ukrainian Startup Fund, which was behind 90% of the publicly known grants in previous years, has stopped issuing grants, but at the same time, the Google for Startups funding campaign for Ukrainian startups in Poland has been launched.

In fact, in 2022, 58 out of 80 publicly known grants were awarded by Google. In 2023, Google for Startup was exhausted, but there were signs of the Ukrainian Startup Fund's recovery: 25 grants of $5 thousand were distributed, and there are also reports of perks—"grants" in kind, such as organizing participation in conferences and competitions.

ACCELERATORS

Over the past 5 years, the activities of more than 10 incubators and accelerators have been reported in Ukraine, 5 of which were publicly demonstrating their activities before the Russian invasion: Ukraine's 1991 Accelerator, the US-based Techstars, the UK-based Blue Lake Accelerator, the Estonian Startup Wise Guys, and the Spanish Demium.

After February, 24, 2022, among the accelerators, only Startup Wise Guys, which added 10 startups with a Ukrainian team and a Ukrainian co-founder during this period, is publicly known to have made cash investments. In 2022-2023, Eric Schmidt's D3 accelerator, focused on Military Tech, was also launched. The accelerator saw its first startups in June 2023, and the first and so far only investment in the startup Swarmer took place at the end of H2 2023.

V. Market

As mentioned in the first section, the largest number of people in Ukrainian IT are involved in products in the E-commerce, FinTech, Utilities, GameDev with Gambling and Betting, as well as AdTech and MarTech verticals. In addition, over nearly 2 years, the DefenceTech vertical has taken shape, employing an estimated 7,000 to 10,000 people.

However, the largest local e-commerce companies work for the domestic market. Fintech and Utilities, while having one of the highest rates of revenue per employee, are heterogeneous, so it's hard to compare them in the same rating, and many of the latter make money from traffic arbitrage and card schemes rather than the product itself. As for DefenseTech, it is not yet a topic for ratings. In addition, ⅔ of people generally touch upon product verticals exclusively in outsourcing.

In this section, we have prepared the top large and well-designed verticals of Game Dev and Outsourcing, and offered their representatives to comment on the following things:

-

How has the market for their vertical changed in Ukraine over 18 months of war?

-

What are the peculiarities of the local market, if any? Are there any specific challenges it is currently facing?

-

Apart from losses, were there any gains in the vertical? Growth of certain niches, new niches, or the opening of new noteworthy businesses?

-

Which companies in your vertical are worth following?

-

What is the forecast for the vertical for the next six months?

We have also prepared separate tables of prominent product companies from Ukraine, the largest local players in each vertical, and the offices of global tier 1 companies that are still present in Ukraine.

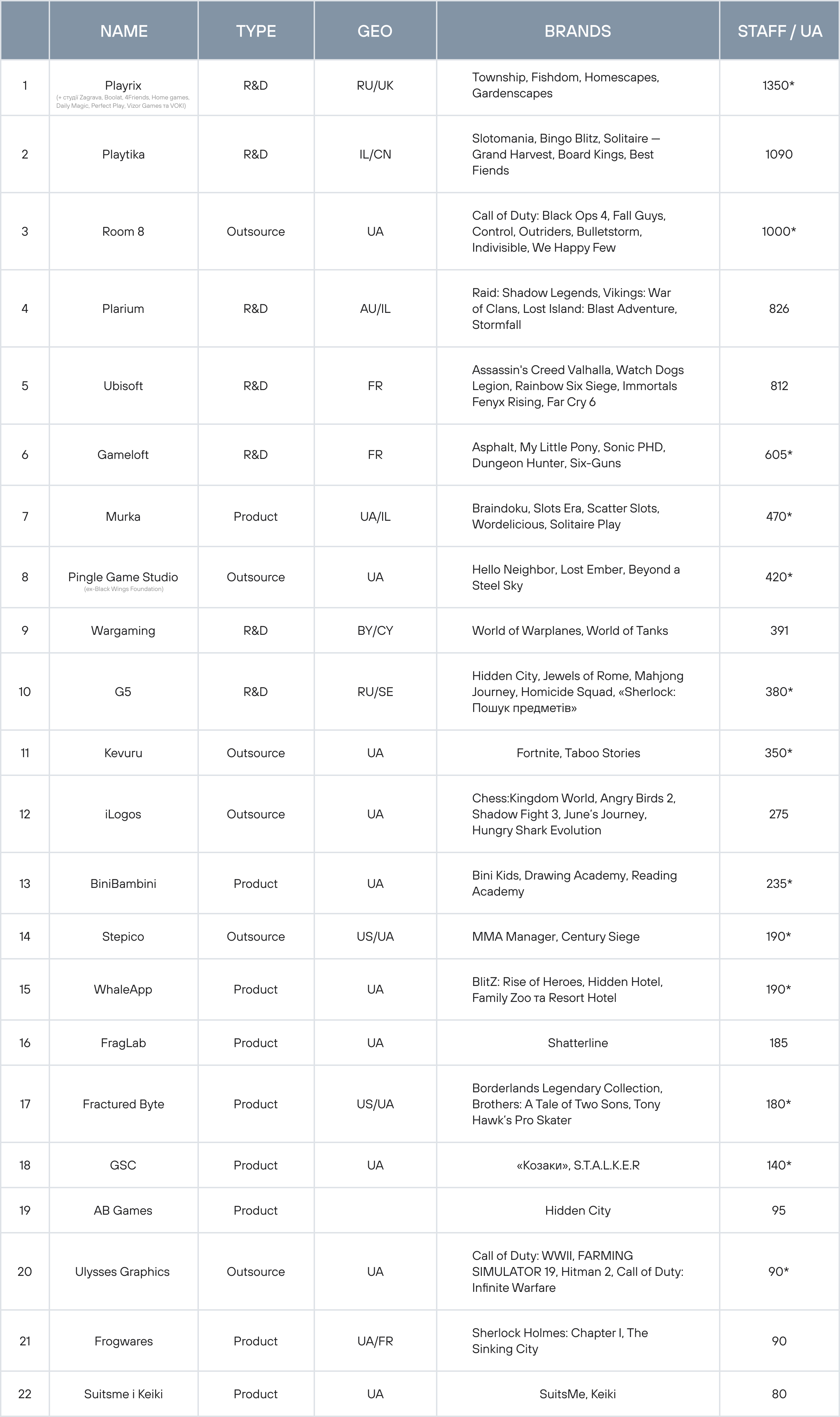

GameDev

Oleksandr Khrutskyi

the organizer of the largest Gamedev conference GamesGathering

More than half of the people working in the Ukrainian gamedev industry are involved in outsourcing projects. Unfortunately, with rare exceptions (except for studios, 4A, GSC, and Frag Lab), there are no teams that could claim the title of AAA project developers. Speaking about the situation now, everything is certainly not perfect, but the situation could have been much worse.

Today, I know of only one foreign Gamedev company that has completely closed its Ukrainian office. Almost all the studios that had been operating in Ukraine before the war continued to work. Surprisingly, the fact that the war started scared investors and partners less than the fall and winter rocket attacks and power and internet disruptions. In the spring of 2022, almost no one stopped working, and in the fall and winter, some studios laid off up to 15% of their staff. The main difficulties now are the loss of staff and investors' fear of investing even in the later stages of project development. Another factor is that it is difficult or impossible to leave the country for those who need to meet with partners in person.

Challenges for the industry globally, as well as for the entire global gaming industry, are to survive the post-COVID pullback and the impending global financial crisis. The Ukrainian gaming industry, in particular, faces the challenge of convincing foreign publishers and investors that it is a reliable partner for cooperation, despite the Russian threat. And Ukrainians have been proving this for a year and a half, not just in words, but through their actions.

scroll to see more

GamesGathering

Also, over the past 5 years, Ukrainian gaming industry has been actively hiring and at different times had or has more than 50 employees at EJaw, Boss. Gaming, Clovertech, Flime (by Gismart), Playgendary, Belka, Volmi, Product Madness, AAA games, 4A Games, and Moon active.

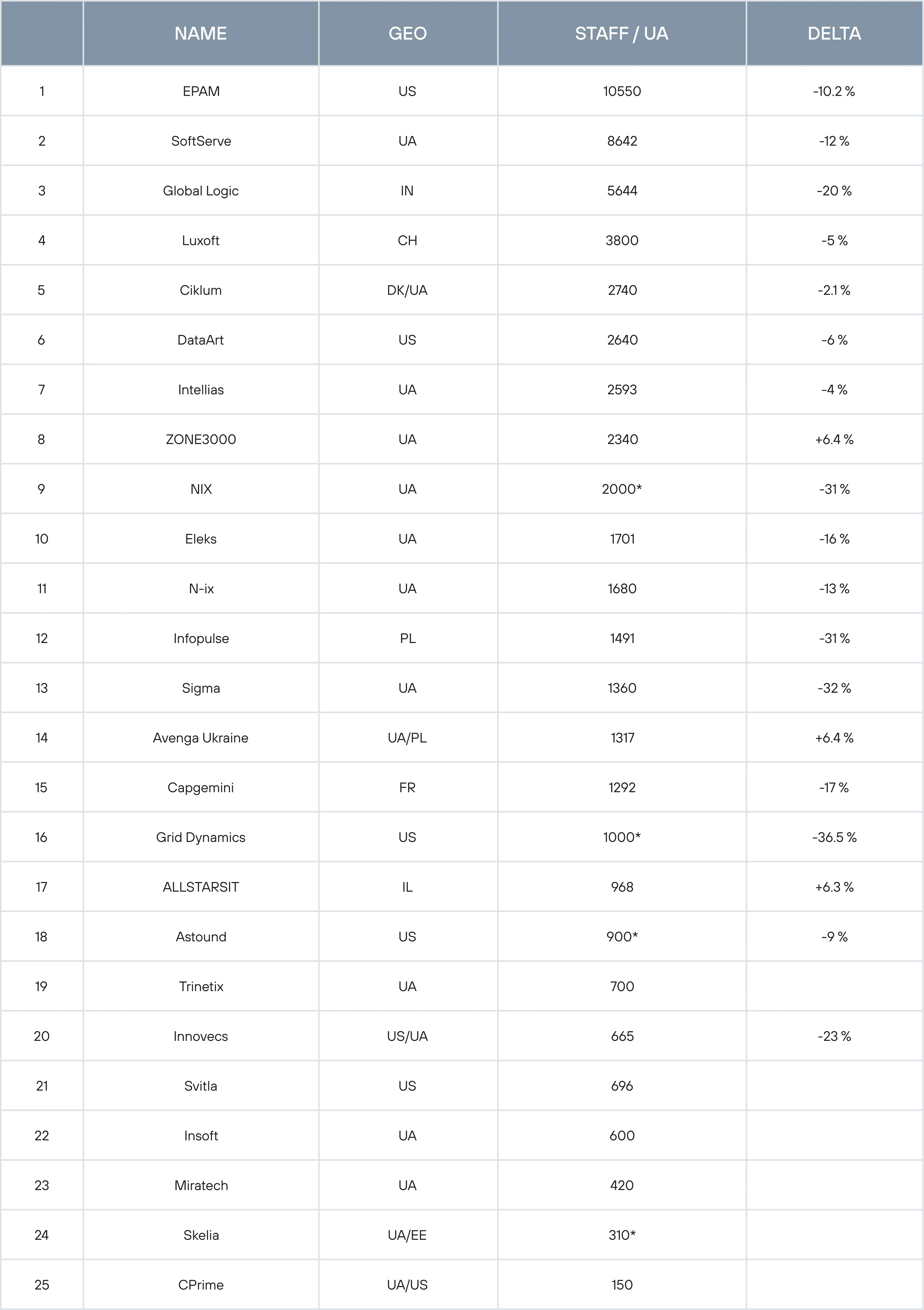

Outsource

Vitaliy Horovyi

Investor at InSoft.Partners, an outsourcing company

Before the full-scale invasion, the Ukrainian outsourcing market was growing by an average of 20-25% per year, and the year 2021 was also rich in M&A deals - from the consolidation of existing players to the arrival of new foreign companies through the purchase of local assets. However, the same thing happened all over the world - the demand for programmers exceeded the supply in the labor market by about two times.

The war certainly had an impact on this. No matter what we want to think, the world continues to live at this time and in many cases takes the path of least resistance. On the other hand, we still benefit from the accumulated expertise and the simplified taxation system, which allows individual entrepreneurs to accept money directly from foreign legal entities. In general, the absence of excessive government regulation of the old format once allowed the industry to build the proper business models from the start, rather than "schemes," which is why many clients stick with us and are not going to take their business elsewhere. The Ukrainian outsourcing industry is more strongly affected by the global recession, which economists have been arguing about for quite some time, whether it has already begun or not. At the end of 2022, the demand for software development dropped significantly, according to some estimates, by as much as 25%.

If the question of who is worth following in the market is simply about growth, it is difficult for me to comment, there is a lot of insider information. If we are talking about non-trivial approaches or an interesting business model, I would keep an eye on Intellias and Avenga, which have embarked on a difficult path of inorganic growth through M&A".

scroll to see more

InSoft.Partners

Table of Ukraine's largest outsourcing companies:

*the company did not provide information, the above figure is an estimate based on previously known data and an assessment of the dynamics based on indicators taken from open sources.

*Calculation is based on the number of employees physically located in Ukraine for each company, not on all employees nominally assigned to the Ukrainian office.

Also, over the past 5 years, Ukrainian outsourcing has been actively hiring and at various times had or still has more than 150 employees at Andersen, Star (ex-Cogniance), Intetics, Intersog, Provectus, and ISD.

VI. State Regulation of IT

Diia.City Tax Regime

On February 8, 2022, a special tax regime for IT called Diia.City was launched and became the biggest headline for the Ukrainian IT market. Companies that become residents can opt for a 9% tax on withdrawn capital or an 18% income tax. The tax for employees and gig contractors (a type of labor relationship within the regime similar to freelancing - Ed.) is 5% of income + 1.5% military fee + 22% unified social tax (i.e., for a developer with a net salary of $2,500, this means about $202 in tax - Ed.)

The regime has received mixed criticism, but as of the summer of 2023, about 600 companies have registered at least one of their legal entities as a resident in Diia.City. It is currently known that in Diia.City, companies chose the withdrawn capital tax twice as rarely as the income tax, and in terms of money, the withdrawn capital tax revenues in the first quarter of 2022 amounted to UAH 80.5 million, which is approximately 1% of all UAH 32.2 billion of IT taxes in 2022.

Diia Services

Diia.City is one of the projects of the Ministry of Digital Transformation under the umbrella of the Diia brand of digital public services. During the first year of the full-scale war, the service launched a bunch of new services: change of residence, sharing of vehicle registration certificates, transfer of funds to support the army, "eDocument" temporary digital documents for those who may have lost their documents during the evacuation, the ability to report war-damaged housing, obtaining unemployment status, changing the data of a sole proprietor, a certificate of residence, and much more.

Currently, it is not known how many functionaries the service has already replaced, but it is generally well-received by users, who numbered 18 million at the end of August 2022. Before the war, Ukrainians who criticized Diia for lags and suspicions of insufficient protection against cyber threats, faced with wartime problems, and foreign equivalents, began to sing the praises of the Ukrainian level of digitalization.

2% Single Tax

Almost immediately after the full-scale invasion began, the Ukrainian parliament voted in favor of introducing business incentives, including the well-known 2% single tax for individual entrepreneurs and legal entities, as a way to stimulate business.

The rate proved popular: by the end of May 2022, more than 200,000 businesses had switched to it. But it was also used by companies with huge turnovers. In August 2023, the Parliament supported the draft bill abolishing the 2% rate.

Two Years After the Legalization of Gambling and Betting

In the summer of 2020, after 11 years of prohibition, Ukraine legalized gambling as an incentive to move the existing business vertical from the gray zone to the white one. In 2022, this newly legalized market segment was often criticized: from the use of tax incentives designed for small and medium-sized businesses to miscoding. In early 2023, the National Security and Defense Council imposed sanctions against dozens of gambling and bookmaking operators in Ukraine, most of which had Russian roots, but several local operators and payment systems were also included in the list.

Some even had a Ukrainian license. Currently, the country is reorganizing the Commission for Regulation of Gambling and Lotteries (CRGL), the body responsible for issuing licenses. According to the media, a scenario is being considered whereby the CRGL will be subordinated to the Ministry of Digital Transformation.

Open Data and Registers

Wartime threats were cited as the reason for closing a significant part of open data and state registers. For example, the State Register of Property Rights to Immovable Property, the Unified State Register of Legal Entities, Individual Entrepreneurs and Public Organizations, the State Civil Register, etc.

The initiative was criticized, and later some registers became open again: in August 2022, the state Open Data Portal resumed its work. The register of legal entities and individual entrepreneurs was opened in December 2022. In the spring of 2023, the State Statistics Service published the financial statements of Ukrainian companies for 2022.

Google Tax

The year 2022 also showed whether the so-called "Google tax" works: the obligation of non-resident companies to pay 20% VAT on online services they provide to Ukrainian users was introduced in 2021.

Many companies, such as Amazon, have accordingly announced a 20% increase in prices for Ukrainians. In 2022, such companies paid 53.4 million dollars and 33.7 million euros in this tax. And according to data for the first quarter of 2023, the largest payers of the "Google tax" were: Google Play, Google, Etsy, and Amazon: Google Play, Google, Etsy, SONY, Netflix, and Apple.

Crypto on Pause

Ukraine is in the process of legalizing crypto assets. One draft bill that provides legal grounds for such activities was adopted in February 2022, on the eve of the invasion. The document defines the concept and legal status of a virtual asset, as well as addresses the issues of ownership and transactions in such assets in Ukraine. However, it will not start working until MPs vote on another bill that defines tax rates on crypto transactions.

Meanwhile, the pause in the legalization of crypto has left the market partially in a "gray zone": crypto exchanges are not operating, and crypto transactions are considered high-risk. The NBU, having "tightened the reins," planned to fight the illegal use of crypto in the gambling business. However, as a result, cryptocurrency companies cannot open bank accounts and exchanges cannot use acquiring services.

Decriminalizing Porn

Ukraine is preparing a bill to decriminalize pornography, referring to Article 301 of the Criminal Code, which is a legacy of the Soviet era. And according to which everything from posing on OnlyFans, which in 2023 already paid $928,200 in "Google tax," to the innocent exchange of nudes on WhatApp with mutual consent can be considered a criminal offense. It is proposed to decriminalize only the content that is not harmful.

This does not include cases such as violence, child pornography, unauthorized distribution of other people's personal videos and photos, coercion, and human trafficking—the authors of the bill propose to toughen the responsibility for such offenses.

VII. Afterword

Imagine there is no war. 300,000 engineers, managers, and marketers of all types are working at 6,000-8,000 product, outsourcing, and R&D centers, along with an ‘army’ of freelancers. 11 unicorns started from Ukrainian garages, and more than half of them still have notable tech offices here. Dozens of M&As that are estimated 9-digit numbers. Now imagine war. Tens of thousands of people from the industry have left, and under ten thousand have gone off to fight. Hundreds of thousands spent the winter in the dark.

Multipliers dropped, and some customers left. But builds were delivered on time and business plans were fulfilled. Export revenue from IT sank, but it did not plummet. A new, restrained interest appeared. Now imagine what the Ukrainian tech miracle will look like after the War for Independence ends? You can make this happen not only by investing in Ukraine but also by supporting Ukraine's defenders and civilians.

We've taken this opportunity to highlight a few initiatives with a proven track record:

-

The Come Back Alive Foundation is the largest and most well-known foundation that has been helping the Ukrainian military since 2014, when Russia first occupied Ukrainian land. During this time, the foundation has raised more than UAH 8 billion and is authorized to purchase and import military and dual-use goods.

-

A project of Ukrainian IT professionals together with AIN.UA Braveproject is a 1 million pixel board, a twist on the famous Million Dollar Homepage. For every $1 donation, you are offered 1 pixel on the board where you can place your banner. In August and September 2023, the project raised $100,000 for Esper Bionics bionic prosthetic arms and FPV scout drones.

-

The KOLO Foundation of IT professionals from many well-known Ukrainian IT companies has raised UAH 470 million for drones, thermal imagers, and radios since its inception and provides an opportunity to do so on a subscription basis.

VIII. Sources and Methodology

Ilya Boshnyakov

author of the report

The report focuses on the Ukrainian IT industry. We define the IT industry as a set of companies that meet the following criteria: have at least 40% of their staff engaged in IT; earn their income from operating their own technology products; get royalties from the sale of intellectual property rights to their own tech products; or engage in custom development of tech products. The report also takes into account some companies where the number of IT employees may be less than 40% in relative terms, and the IT part of the business is a component of a land-based product, but they have significant results, and their product, as we know it today, would not be possible without IT. We are talking about some retailers, banks, telecommunication, and logistics companies. For this report, we reviewed 26 studies of various aspects of Ukrainian IT over the past 7 years, found and normalized or calculated KPIs of companies, market verticals, and phenomena in people, traffic, revenues, and investments, in some cases over the past 25 years. We also used the proprietary data of AIN.UA editorial office, which has been Ukraine's main technology media outlet since 1999.

AIN.UA

The following sources were also used in the preparation of the report:

-

Datasets of Dealroom, Pitchbook, CBInsights, Clutch, DOU and Djinni surveys and statistics

-

Data from the Telegram channel "Conspekt"

-

Survey of Lviv IT Cluster and IT-Ukraine Association

-

Data from the State Tax Service, the State Statistics Service, the Ministry of Economy of Ukraine, the Ministry of Education and Science of Ukraine, and the Ministry of Digital Transformation.

Also contributed to the creation of the report:

Ilya Boshnyakov

author of the idea,

author of the report

Nikita Izmailov

co-author

Maksym Zrazhevskyi

co-author

Yana Protsenko

producer, manager

Anna Tian

manager

Olha Khmil

researcher

Kateryna Kovtun

researcher

Maya Yarova

journalist

Illia Kabachynskyi

journalist

Tetiana Hrytsyk

journalist

Olha Karpenko

journalist

Lisa Palchynska

journalist

Oksana Savchuk

illustrator

Artycoders

design and layout

Useful material? Save so as not to lose