Remote ID module and a single interface for servicing individuals and individual entrepreneurs.

Remote ID module and a single interface for servicing individuals and individual entrepreneurs.

Why PayForce?

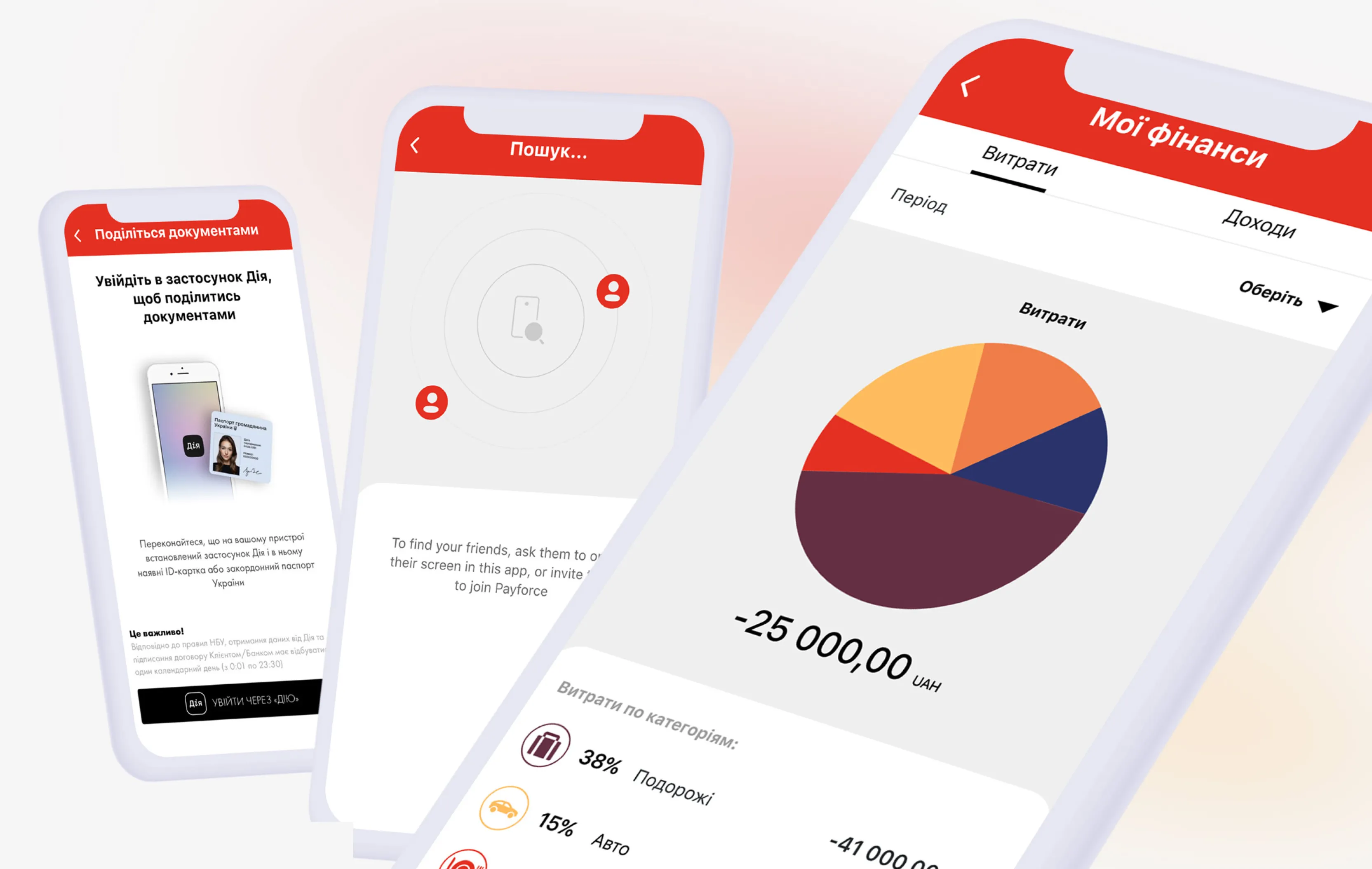

PayForce, a Ukrainian company, has been developing fintech solutions for banking and retail customers for over eight years. Its key product is a multimodule online banking system that has been implemented by over a dozen banks to offer remote services to their customers. One of the advantages of this solution is the ability to increase its functionality by adding more modules. A bestseller is the Remote Identification Module and the Single Interface for Servicing Individuals and Individual Entrepreneurs (IE).

Within the AIN.UA & PayForce joint project, a journalist talked with its team and clients — Kredobank and Industrialbank — about how these two technology solutions are specific to the Ukrainian market and how both banks benefit from them.

PayForce's key product is the online banking platform for individuals, IEs, and legal entities. Such banks as Industrialbank, Kredobank, Bank for Investments and Savings, and Commercial Industrial Bank have already integrated it into their customer service technical solution portfolio. The system is multimodular, so any customer can choose a required level of functionality.

A business can opt for a basic set of features, such as product registration, user management, deposit and loan handling, card management, payments, and transfers, and then extend the functionality with extra modules developed by PayForce’s in-house team that has completed more than 50 successful implementations to date.

The portfolio also has various solutions: Transfer by Phone Number, Geolocation Transfer, Sharing Bills with Friends, Currency Exchange, Personal Financial Manager, etc. However, the most beloved by the customers are two of them — the Remote Identification Module and the Single Interface Solution for Servicing both Individuals and Individual Entrepreneurs.

Why is the Remote Identification

Module from PayForce so unique?

Why is the Remote

Identification Module from PayForce so unique?

Using this solution, one can become a bank client by passing the identification via Diia or BankID. With the solution, people can become bank customers remotely without visiting banks, which became especially important during the full-scale war as so many Ukrainians left the country. PayForce started developing this module as the National Bank of Ukraine allowed banks to use this kind of personal verification technology. And in July 2021, the company was one of Ukraine's first Remote Identification Module vendors.

Our module has many advantages: First, our remote ID solution is market-ready. It only needs to be integrated into online banking backend and frontend systems, which is much faster than starting its development from scratch. We also provide full technical support for the system. Second, we don’t charge any fees per identification of a potential customer from our clients. We offer a “golden license,” meaning the whole module with related non-exclusive IP rights,

The Remote Identification Module supports Liveness Detection and FaceMatch technologies, which allows for comparing instant photos of clients with those delivered through the system and identifying whether a person’s identity is true. During the module development, the PayForce team used up-to-date libraries and models to analyze faces by splitting them into hundreds of pixels. So this makes authorization with digital reproductions impossible. The technology has been developed for several years and is constantly being upgraded, which is another guarantee of bank clients’ personal data security.

How does it work? Thanks to Liveness Detection, a bank client takes a picture, and FaceMatch ensures its proper comparison with their photo in the Diia app. The simultaneous use of these two technologies makes any fraud impossible.

Our system compares the faces whether they match, and if so, a client is considered identified. Some banks prefer to do this manually: an operation specialist checks the pictures per hand if they belong to the same person and then press a confirmation button, allowing the customers to continue their transactions. If it goes automatically, it’s more comfortable and faster. It becomes smoother and doesn’t make the client wait, and that’s an additional guarantee that the client would finish the authorization to become a full-fledged client of the bank,

“We started our fruitful cooperation with PayForce in 2017 by developing innovative mobile banking that would allow online issuing prepaid credit cards and their digitalizing in an app, making a smartphone a point of sale. It was long before Apple and Google Pay wallet products appeared in the Ukrainian market. And it was the only solution in Ukraine because other banks had separate payment apps while we had an all-in-one app with the online prepaid credit card issue option.

By continuing the development of our mobile banking system, we and PayForce launched the Remote Identification Module, so crucial for us, in the beginning of this year. Thanks to it, now we can attract new customers who don’t need to visit bank offices. The power of this solution is in a simple and fully automated identification via Diia, realtime face recognition from a picture, and automated comparison with a photo in Diia so that no authorization with photo reproductions is possible.

Nowadays, the Remote Identification Module allows the clients not only to use classic bank products but also discover new ones, including our new function developed in cooperation with PayForce—a messenger integrated in the mobile banking system. The new module that lets clients of a single bank communicate with each other, send pics, voices, emojis, is encrypted and fully secure,”

A single interface for servicing both individuals and IEs. Why is it useful?

A multimodule mobile banking system, a core product of PayForce, offers its clients some other unique solutions — for example, a single interface for servicing individuals and IEs in one app showing all products in a single screen where you can transfer money from an IE’s account to an individual’s account without switching between screens.

Many Ukrainian professionals work as individual entrepreneurs. At the same time, they are still individuals and not legal entities in the case of bank transactions. So, when a person opens an app where many accounts are to see, switching between banking interfaces, for example, to transfer money from an IE to an individual to be spent by this individual, isn’t an easy way of operation,

PayForce launched this solution over five years ago with a deep understanding of client needs and mobile banking users. In the meantime, the product has been extended by a Remote Identification Module for Individual Entrepreneurs. It makes it possible to open accounts in Ukrainian banks and do other everyday transactions easily and remotely — anywhere in the world.

The legal form is totally different. However, still, it’s the same person — an individual entrepreneur and an individual human being — who gets the absolutely same service within a single interface and the same user experience. So, the banks can use this product to attract more clients. A solution for IEs would be one thing. But the other thing is a 2-in-1 solution covering both IE’s and individual’s needs. And this very client also can be attracted remotely. Those are advantages of our solution making it unique,

“Kredobank started working with PayForce in 2018 by implementing an online banking platform for individuals and individual entrepreneurs. Together, we developed mobile apps for iOS and Android and a web version and smoothly integrated it with the Pay4 P2P-transfer service from PayForce.

One of the advantages of the online banking implemented by Kredobank and PayForce is using accounts of an individual and an IE in the same app and on the same screen. Our clients can check their account balance as individuals and individual entrepreneurs at the same time. This saves time for getting extra permissions and doing additional logins. Another plus is that IEs don’t require to have a separate e-signature from Kredobank. After we did the integration, almost every e-signature certified in Ukraine can be used in our online banking system.

Now our teams are working on another interesting and quite ambitious project, about which we will tell you later when we prepare a beta,”