Since 2015, Ukrainian company PayForce has been developing full-cycle fintech solutions. The company was founded by a team from the banking sector who perfectly understood the pains and needs of their potential customers. This understanding allowed them to quickly establish PayForce as a reliable partner for major players in the financial and retail sector, such as

KredoBank, Bank for Investments and Savings (“Банк інвестицій та заощаджень”), Industrialbank (“Індустріалбанк”), Commercial Industrial Bank (“Комерційний індустріальний банк”), and AMIC Energy.

AIN.Capital spoke with Tetiana NikolenkoTetiana Nikolenko, co-founder and deputy CEO of PayForce, and in a joint project, we tell about the services the company offers and why its expertise and range of solutions are unique for the Ukrainian market.

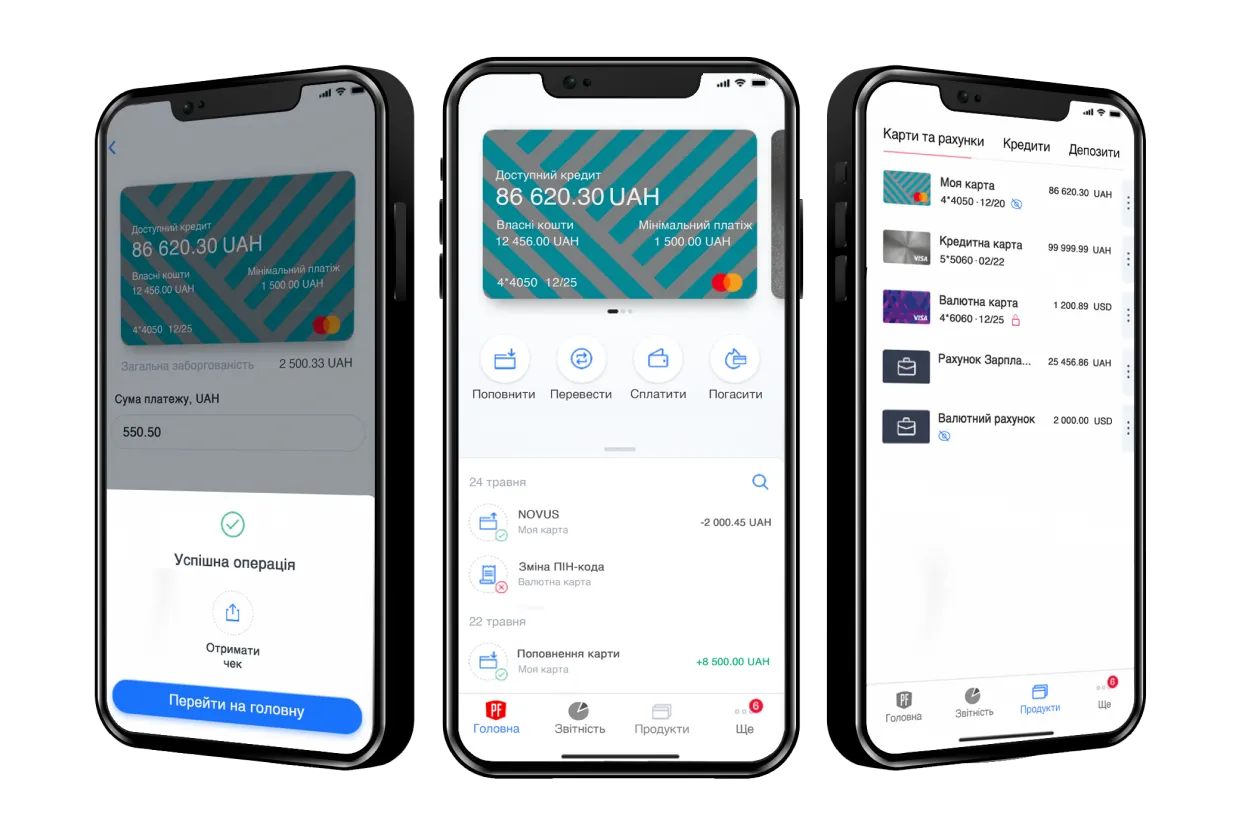

Multimodule online banking system is PayForce key product

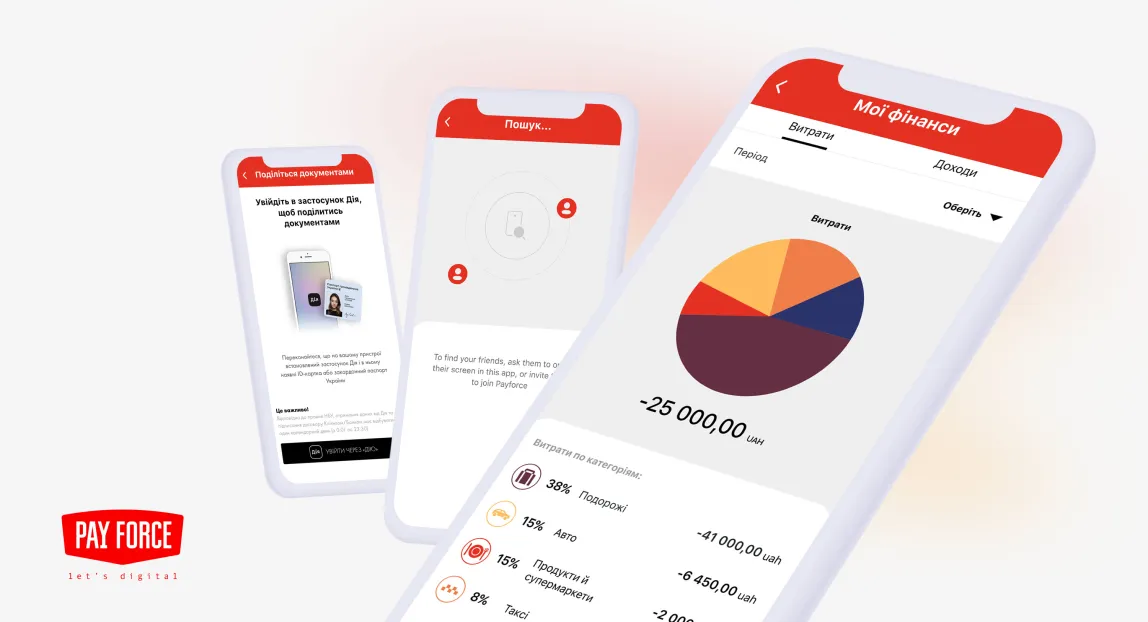

The online banking platform for individuals, individual entrepreneurs, and legal entities is the primary PayForce solution. It is integrated by more than 10 banks to offer remote services to their customers. This platform is multimodular, allowing clients to select the level of functionality that aligns with their business needs. This means that at the outset, a business can opt for a basic set of features, such as product registration, user management, deposit and loan handling, card management, payments, and transfers. Additionally, customers can integrate new features as their system evolves, customizing them to suit their specific business processes.

PayForce develops a multitude of additional modules and has completed more than 50 successful implementations to date.

Here are just a few of them:

Remote Identification Module

Transfer by Phone Number

Opening a Digital Card

Geolocation transfer and bill sharing with friends

The referral program and cashback

Currency Exchange

Chat with Operators and Customers

Personal financial manager

Segmented Messages

“Our solution also includes an administrative module, a versatile standalone system for managing all online banking functions. It empowers customization of products, module enablement or disablement, session viewing, commission and limit management, and more. The system facilitates dynamic banner management, display advertising, and the rapid adjustment to changes in current legislation through a wide range of configurations,”

Tetiana Nikolenko, co-founder and deputy CEO of PayForce

Tetiana Nikolenko, co-founder and deputy CEO of PayForce

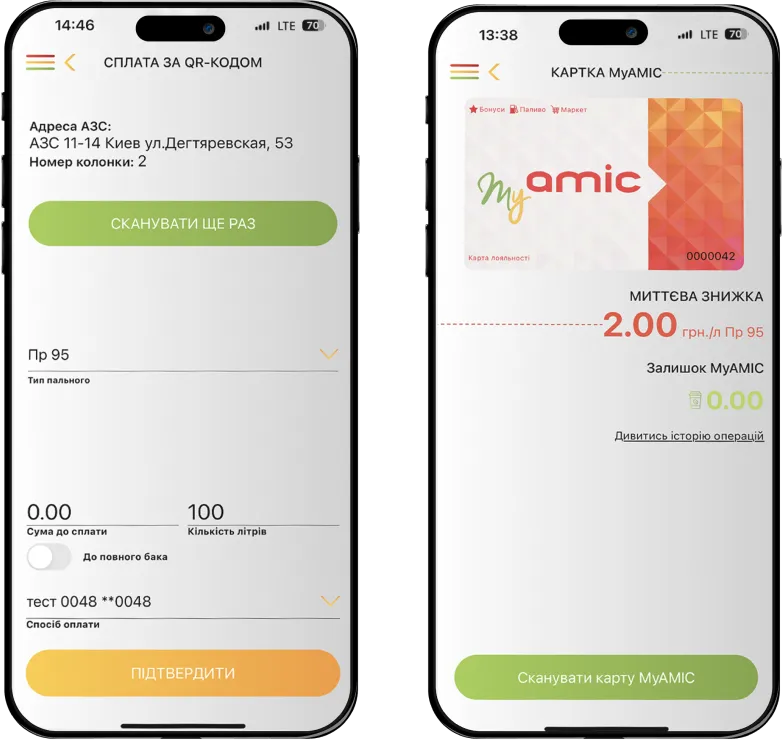

PayForce products are not only for the banking sector

PayForce solutions are adaptive, and this feature makes them used by businesses in the financial sector and retail, including KredoBank, Bank for Investments and Savings (“Банк інвестицій та заощаджень”), Agroprosperis Bank (“Агропросперіс Банк”), Industrialbank (“Індустріалбанк”), Commercial Industrial Bank (“Комерційний індустріальний банк”), and AMIC Energy.

Additionally, the company's products are valuable for other fintech-related businesses, such as financial companies, credit institutions, and insurance companies.

Full-cycle development and adaptability of solutions to changes: what arethe advantages of PayForce?

One of the advantages of PayForce is its provision of full-cycle fintech product development services, including the creation of technical specifications for clients and the development of individual designs.

“Our in-house team can create a unique design for each bank or, at the client's request, we can offer ready-made mobile application templates with a basic interface. Additionally, we independently prepare the technical specifications, considering the specific needs of each client's business processes. We possess the necessary expertise for this task. Furthermore, our system features open APIs, enabling us to seamlessly integrate any design developed by another design company for our clients,”

says Tetiana Nikolenko, co-founder and deputy CEO of PayForce

In addition to online banking system development, PayForce also provides card tokenization service and the integration of these functions into mobile banking. This allows bank customers to make payments using Apple Pay, Google Pay, Garmin Pay, and SwatchPAY.

One of the advantages of PayForce is its provision of full-cycle fintech product development services, including the creation of technical specifications for clients and the development of individual designs.

Tetiana Nikolenko, co-founder and deputy CEO of PayForce

In addition to online banking system development, PayForce also provides card tokenization service and the integration of these functions into mobile banking. This allows bank customers to make payments using Apple Pay, Google Pay, Garmin Pay, and SwatchPAY.

“It's highly convenient because we integrate this functionality concurrently with the development of the online banking system. As a single vendor for the bank, we make this process fast, seamless, and eliminate the need for customers to search for other developers for this module.

Banks can immediately send cards from the mobile application to Apple Pay, Google Pay, and other wallets,”

In addition to the openness of the API and multimodularity, PayForce key customer service product itself offers numerous other advantages and features. Notably, it provides a single interface for serving both individuals and individual entrepreneur within a single application. This interface displays all products on one screen and enables transfers from an individual entrepreneur's account to an individual's account without the need to switch between applications.

Furthermore, as more companies actively enter international markets and global businesses show increasing interest in the Ukrainian market, PayForce possesses all the necessary licenses, certificates, and experience to integrate its modules into the systems of European banks. One of the most significant advantages of working with PayForce is the “golden license.”

“The company transfers non-exclusive intellectual property rights to the software product to the customers, providing them with absolute flexibility and confidence in the future — along with the rights, we also transfer the source code for the product.”

Dmytro Havrykov, founder and CEO of PayForce

Dmytro Gavrikov, founder and CEO of PayForce